vermont sales tax on alcohol

An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax.

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

When a seller does not charge the buyer Vermont sales tax on an item taxable in Vermont the buyer must pay use tax.

. 90 on sales of prepared and restaurant meals. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. There is no applicable county tax or special tax.

The tax on any alcohol beverage served on-premises is 10. Of tax is 500000 plus 15 percent of gross revenues over 10000000. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

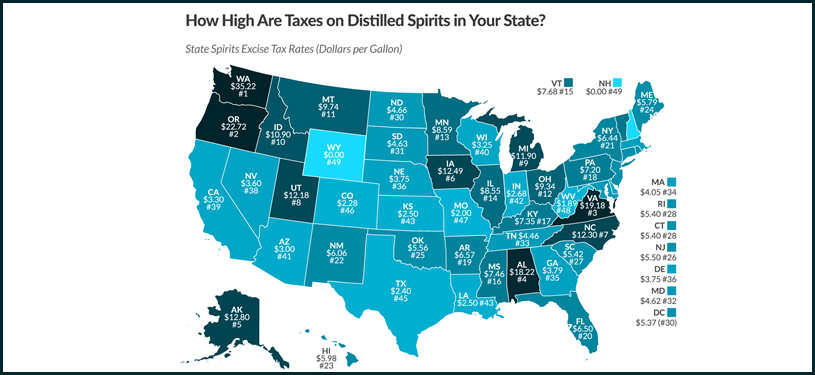

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Meals - 9 alcohol - 10 general goods - 6 rooms - 9.

3 if the gross revenue of the seller is over 20000000 the rate of tax is 25 percent 10. In Vermont wine vendors are responsible for paying a state excise tax of 055 per gallon plus Federal excise taxes for all wine sold. The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax.

An additional tax to consider is the local option sales tax. Local sales taxes can bring the total to 7. Average Sales Tax With Local.

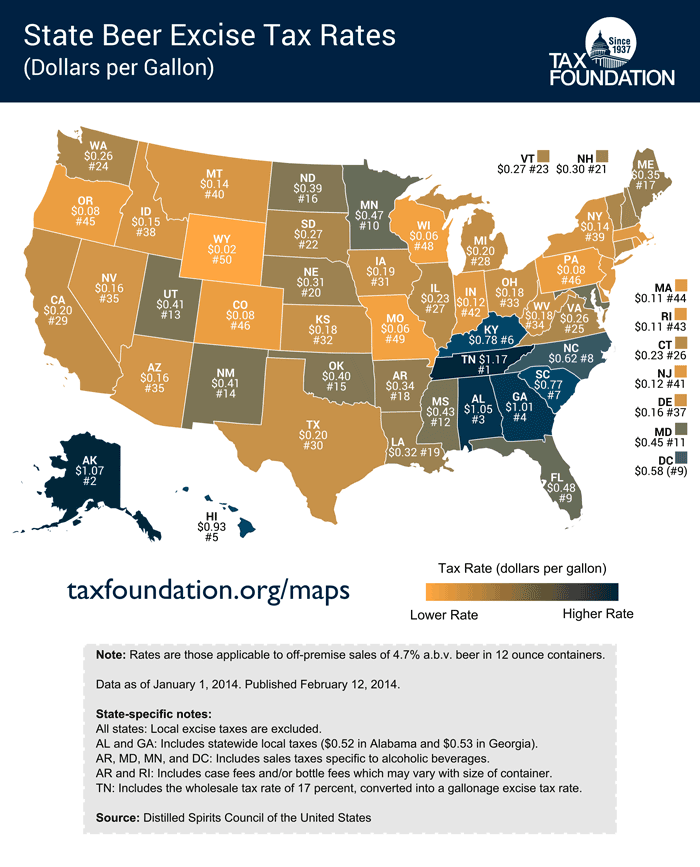

Modified the states alcohol tax by shifting it from a floor tax to a sales tax for wholesalers. The Vermonts state tax rate varies depending of the type of purchase. The second is an excise tax which us 27 cents per gallon of beer and 55.

Delivery in Vermont by the holder of a license shall be deemed to constitute a sale in Vermont at the place of delivery and shall be subject to all excise and sales taxes levied by the State of Vermont. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Vermont Alcohol Tax.

-88817841970013E-16 lower than the maximum sales tax in VT. Increased the alcoholic beverage tax rates for beer wine and spirits. Effective June 1 1989.

Certain Municipalities may also impose a local option tax on meals and rooms. See definition at 32 VSA. Beer and wine are subject to Vermont sales taxes.

The Division of Liquor Control is responsible for the sale of spirits and the enforcement of laws and regulations regarding alcohol and tobacco in Vermont. The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities. 2018 No significant enactments 2017 Delaware.

Beer and wine which are not part of the control system face two types of taxes in Vermont. There are a total of 205 local tax jurisdictions across the state collecting an average local tax of 0093. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected.

For beverages sold by holders of 1st or 3rd class liquor licenses. The sales tax like the rooms meals and alcohol taxes would also be paid by those who dont live or own property in Barre. Vermont has a 6 statewide sales tax rate but also has 205 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0093 on top of the state tax.

If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. 90 on sales of lodging and meeting rooms in hotels. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

The state sales tax is 6. Liquor sales are only permitted in state alcohol stores also called ABC Stores. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

That includes Montpelier which like Barre has a 1 tax on rooms meals and alcohol. Direct Ship to Retail. Vermont Wine Tax 055 gallon Vermonts general sales tax of 6 also applies to the purchase of wine.

This means that an individual in the state of Vermont purchases school supplies and books for their children. Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS.

The tax rate is 6. The Office of Education provides education services to licensees bartenders servers store clerks consumers parents teenagers and anyone else who needs to know how to make sure alcohol. Tax Rates for Meals Lodging and Alcohol.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. The 7 sales tax rate in Manchester consists of 6 Vermont state sales tax and 1 Manchester tax. The sales tax rate is 6.

Vermont Liquor Tax 15th highest liquor tax. A Vermont Alcohol Tax can only be obtained through an authorized government agency. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax.

Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. You can print a 7 sales tax table here. 100 on sales of alcoholic beverages served in restaurants.

Pay directly to the Commissioner of Taxes the amount of tax on the vinousmalt beverages shipped. Altered the liquor tax by changing it from a graduated rate to a flat 5 tax. Sales and Use Tax 32 VSA.

This is a tax that towns in Vermont can opt to include bumping the sales tax from six to seven percent on alcohol. Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. Alcoholic Beverage Sales Tax.

Higher sales tax than 87 of Vermont localities. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities. While other communities in central Vermont have talked about a sales tax none yet has one.

The Essex Junction Sales Tax is collected by the merchant on all qualifying sales made within Essex Junction. This means that depending on your location within Vermont the total tax you pay can be significantly higher than the 6 state sales tax.

Alcohol Marketplaces 2 0 Part 3 Follow The Money

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

Whistlepig Farm Piggy Back 6 Year Old Rye Whiskey Vermont Prices Stores Tasting Notes Market Data

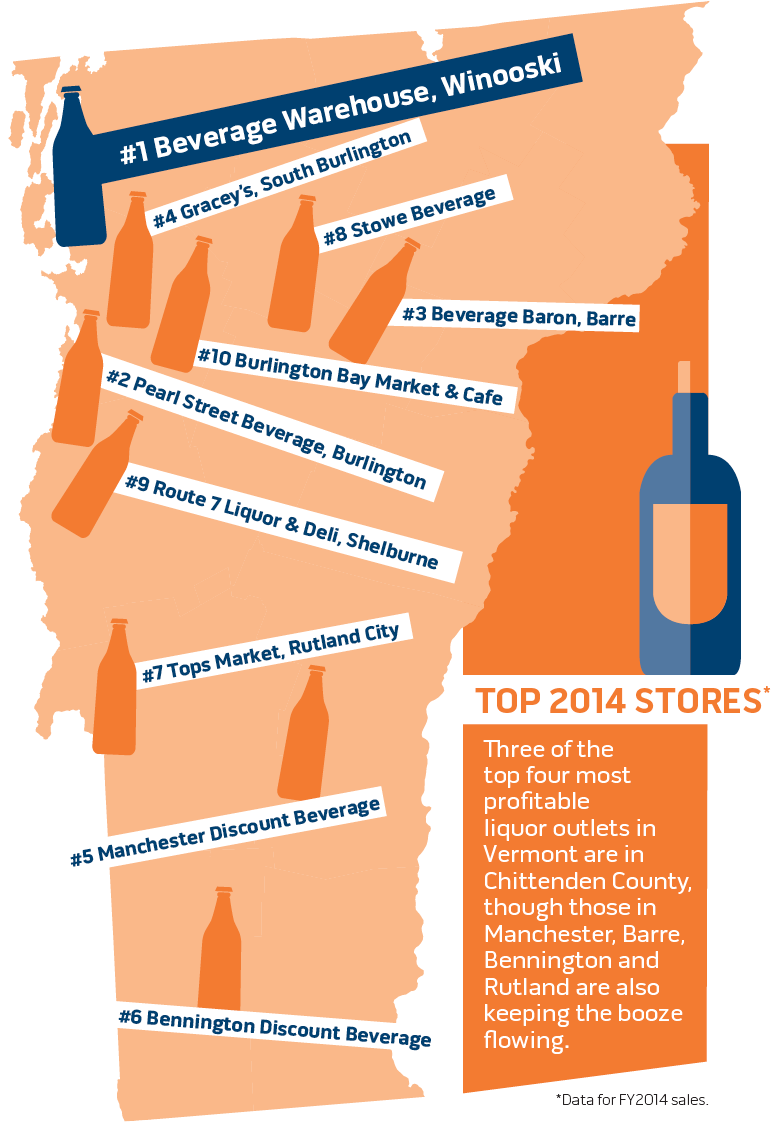

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Alcohol Taxes On Beer Wine Spirits Federal State

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Alcohol Taxes On Beer Wine Spirits Federal State

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

A New Wave Of Vermont Distillers Pushes Legislators To Modernize Liquor Laws Business Seven Days Vermont S Independent Voice

These States Have The Highest And Lowest Alcohol Taxes

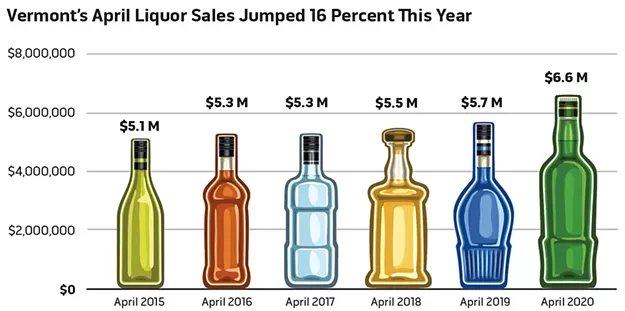

Booze Blues Liquor Sales Are Up But Vermont S Alcohol Industry Is Struggling Business Seven Days Vermont S Independent Voice